|

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Can Broadcom Stock Hit $420 in 2025?/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)

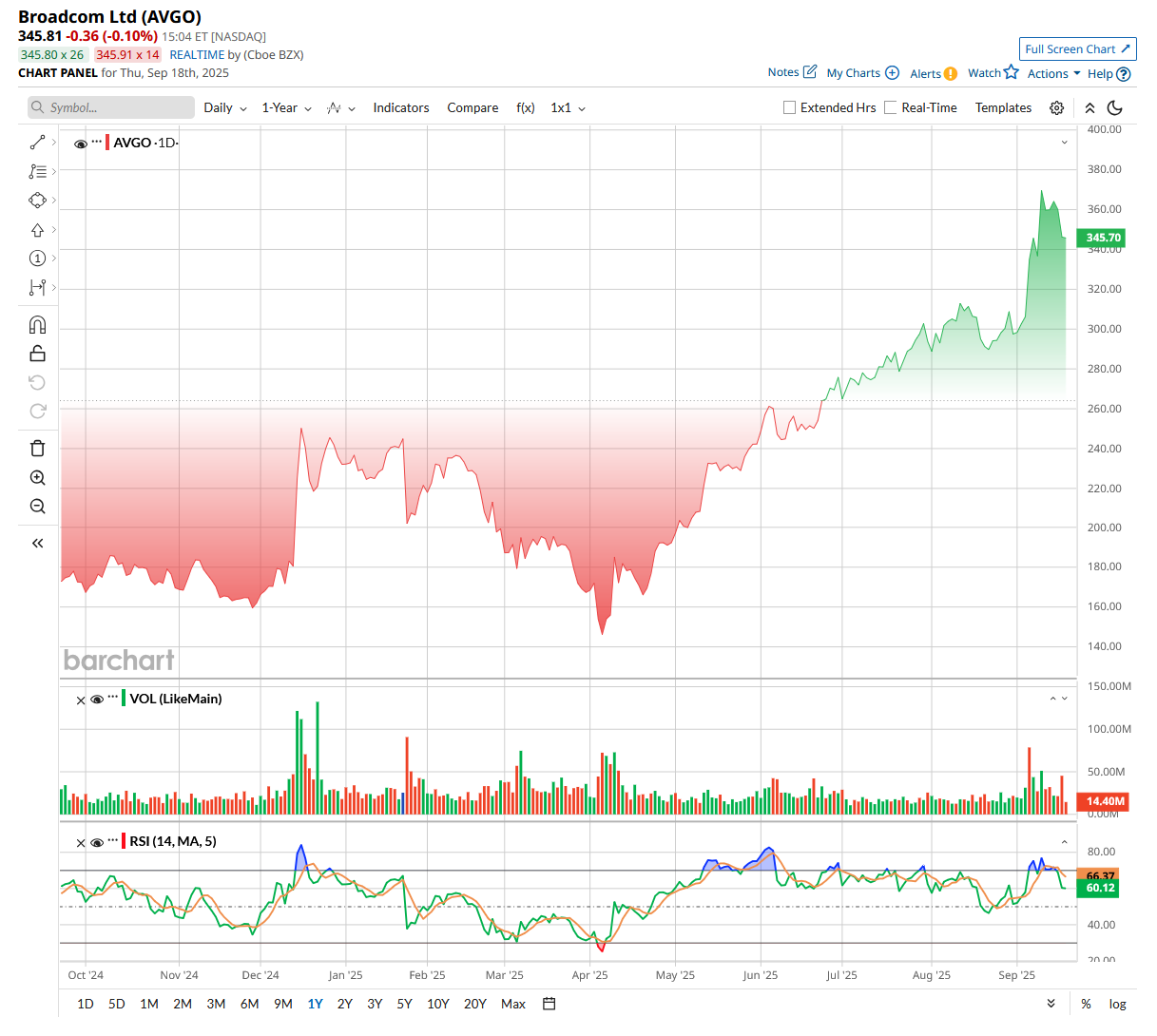

Broadcom (AVGO) is no stranger to Wall Street’s spotlight, but in 2025, it is playing a different game altogether. While much of the tech sector is still recalibrating after years of turbulence, Broadcom is sprinting ahead, positioning itself as indispensable infrastructure for the artificial intelligence (AI) revolution. In the world of Wall Street, momentum feeds on headlines, and Broadcom just handed investors a feast. The semiconductor and software powerhouse recently reignited investor excitement with blowout earnings and a $10 billion custom chip order linked to OpenAI—validation that Broadcom isn’t just another supplier but a cornerstone of next-gen infrastructure. Its dominance in the application-specific integrated circuit (ASIC) market gives it an edge where performance, efficiency, and customization now outshine general-purpose GPUs. Each new chip cycle demands more power, denser packaging, and higher bandwidth, and Broadcom is the quiet architect making that leap possible, with selling prices often doubling. No surprise, then, that analysts are turning confident. Macquarie just planted the flag with a Street-high $420 price target, underscoring the belief that Broadcom’s AI moat only deepens from here. So, does AVGO stock have the firepower to punch through $420 in 2025? About AVGO StockPalo Alto-based Broadcom, founded in 1961, has grown into a global technology leader over the decades. With a commanding market capitalization of $1.7 trillion, the company powers the modern digital world through a blend of advanced semiconductors and enterprise software. Its products are the unseen foundation of cloud computing, high-performance data centers, smartphones, and industrial automation. Known for stellar revenue and earnings growth, Broadcom’s success reflects a wide competitive moat in networking, wireless, and specialized chips. Today, it stands as one of the world’s most valuable companies, driving both connectivity and innovation forward. Broadcom has turned into one of the market’s headline acts. Over the past year, AVGO has ripped higher by nearly 113.5%, surging past the S&P 500 Index’s ($SPX) 18.1% gain and the Semiconductor Ishares ETF’s (SOXX) 22.8% uptick. Over the past three months alone, the chip stock had a blistering 46.4% run with 24 fresh highs stamped into the chart. Momentum hit overdrive after Q3 earnings unveiled a $10 billion custom-chip order, igniting traders’ appetite. On the technical front, the stock is still flexing—the 14-day RSI hovers around 72, brushing overbought territory, while price action stays firmly above key moving averages.

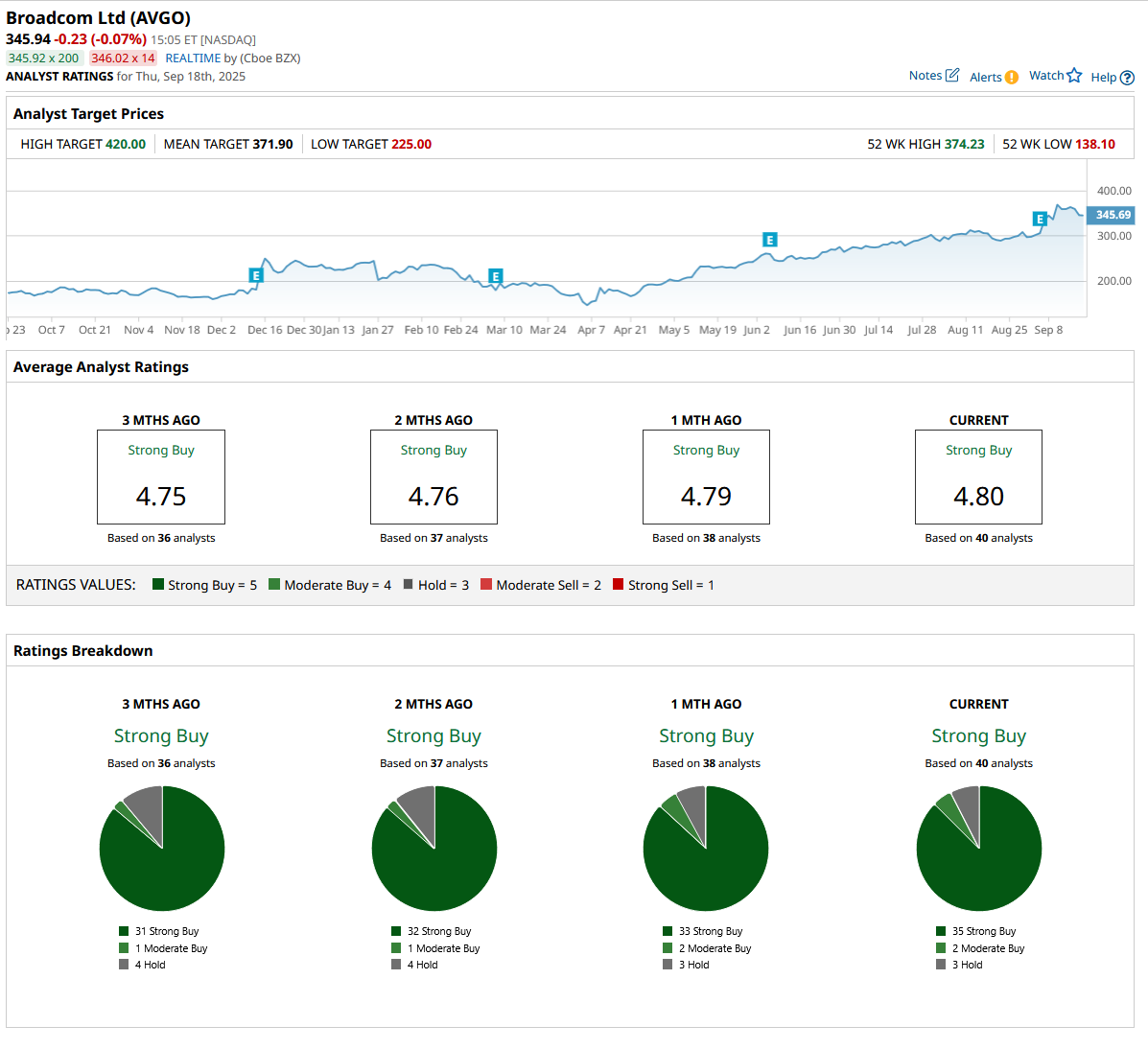

Broadcom’s valuation leaves little room for doubt—it trades at a rich 66.35 times forward earnings and nearly 33 times forward sales, well above industry averages. Investors, however, appear unfazed, signaling confidence in the company’s ability to sustain growth and protect margins over the long term. Elevated multiples often reflect more than near-term expectations; they point to a business model with enduring strength. Meanwhile, Broadcom balances its premium growth profile with consistent shareholder returns. The company offers a forward annual dividend of $2.36 per share, yielding 0.65%, supported by 14 consecutive years of dividend increases. With another $0.59 per share payout scheduled for Sept. 30, Broadcom demonstrates that its story is not solely about expansion, but also about disciplined capital return and long-term stability. Broadcom Exceeds Q3 Earnings EstimatesBroadcom’s Q3 2025 earnings landed on Sept. 4 with the kind of precision that turns heads on Wall Street. AVGO rose 9.4% in the subsequent trading session and 3.2% in the next. The chip-and-software giant’s revenue surged 22% year-over-year (YoY) to $16 billion, edging past expectations, as the company’s twin engines—AI semiconductors and VMware software—drove momentum. Broadcom’s Q3 showcased its rising dominance in AI infrastructure. Fueled by surging demand for XPUs, advanced ASICs that power generative AI workloads. AI revenues soared 63% YoY to $5.2 billion, now accounting for a third of total sales—momentum management expects to sustain in the coming quarters. Tech giants like Alphabet (GOOG) (GOOGL) and Meta (META) rely heavily on these chips, which integrate compute, memory, and I/O for peak performance at lower power and cost. XPUs made up 65% of AI sales, while networking strength from Tomahawk 5/6 and Jericho 4 added momentum. With a backlog swelling to $110 billion and $10 billion in AI rack orders secured, Broadcom’s growth runway remains robust. Meanwhile, profitability followed the same upward arc, with adjusted EBITDA surging 30% annually to $10.7 billion, accounting for 67% of the top line. Non-GAAP EPS climbed 36.3% YoY to $1.69, a lift that gave investors more reason to stay firmly in the bull camp. Free cash flow, a barometer of resilience, surged 47% annually to $7 billion, leaving Broadcom sitting on $9.47 billion in liquidity. Plus, shareholders were not left out. Broadcom returned $2.8 billion in Q3 dividends, underscoring its commitment to capital return. Looking ahead, management projects Q4 revenue of $17.4 billion, with adjusted EBITDA holding at 67% of sales. AI semiconductors are expected to accelerate again, climbing to $6.2 billion in Q4, marking the eleventh straight quarter of AI growth. Analysts’ optimism is sharpening. For fiscal 2025, the Street sees EPS vaulting 46.1% YoY to $5.42, followed by another 40% annual leap to $7.58 in 2026. With AI silicon demand surging and VMware’s software engine humming, Broadcom is stacking gains quarter after quarter, compounding strength like clockwork. What Do Analysts Expect for AVGO Stock?Recently, Wall Street analysts have turned increasingly bullish on Broadcom, with Macquarie setting the tone by initiating coverage with an “Outperform” rating and a Street-high $420 price target. The confidence stems from Broadcom’s near-monopoly in the ASIC market, where it commands nearly a 75% share. Unlike GPUs, which dominate training, ASICs are purpose-built for inference workloads, offering superior performance per watt, rack-level efficiency, and tighter system integration—exactly what hyperscalers need as AI adoption matures. Macquarie projects the ASIC market to expand from less than $11 billion in 2024 to over $80 billion by 2028, and Broadcom stands uniquely positioned to capitalize on this surge. Analysts Arthur Lai and Paul Golding highlight the company’s scale, proven track record, and entrenched customer relationships as key factors that defend its leadership even as rivals like MediaTek attempt to enter the fray. With VMware now contributing high-margin software revenues and non-AI segments showing signs of revival, Broadcom’s case for a higher ceiling looks stronger than ever. Meanwhile, Mizuho Securities lifted its price target to $410 from $355, reaffirming an “Outperform” rating. The brokerage firm’s bullish call is based on Broadcom’s structural tailwinds fueling custom silicon and networking and surging AI revenue trajectory, projecting $39 billion in fiscal 2026, $60 billion in FY27, and $75 billion in FY28, which is well ahead of consensus. Overall revenue and earnings estimates were also upgraded, with fiscal 2026 revenue now pegged at $84.4 billion and EPS at $9.27, rising to $108 billion and $12.13 in FY27, and $124 billion and $14.05 in FY28. Mizuho models a blistering 56% AI revenue CAGR between 2025 and 2028, powered by hyperscaler adoption of custom ASICs, rising ASPs, and expanding relationships with Google, Meta, OpenAI, Apple (AAPL), and ARM (ARM). Networking platforms like Tomahawk Ultra and SUE-lite strengthen Broadcom’s grip on AI infrastructure, while free cash flow could hit $40 billion annually by FY26, supported by industry-leading margins near 77% gross and 66% operating. Wall Street’s conviction in Broadcom is not just about AI hype—it is about consistency. Of the 40 analysts tracking the stock, 35 back it with a “Strong Buy,” two have a “Moderate Buy,” while just three are sitting on the sidelines with “Hold” ratings. AVGO’s powerful rally has already pushed it near the average target of $371.90, leaving some wondering if the easy gains are gone. Yet the Street’s highest $420 price target, set by Macquarie, hints at a 22% upside, underscoring Broadcom’s rising stature in the AI chip race and its grip on custom silicon demand.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|